Market Potential

- Lighting Retrofits for Office Buildings

- Market is Hungry for New Products

- Daylight Harvesting: An Enormous Untapped Opportunity

- What's Been Missing: Cost-Effective Dynamic Daylight Control (DDC)

- Unlocking Daylight Harvesting's Full Potential

- Benchmark Daylight-Harvesting Configurations

- Applicable Floor Area

- Projected Market Penetration

- Projected Aggregate Floor Area Equipped with IntelliBlinds™

- Projected Aggregate Annual Energy Savings

- Projected Aggregate Annual Reduction in CO2 Emissions

- Projected Aggregate Annual Dollar Savings

- Projected Cumulative Sales

- Confidence Level

- Summary of Key Points

Lighting Retrofits for Office Buildings

Non-residential buildings account for a substantial fraction of the energy consumed in the USA. Building systems are constantly evolving to become more efficient, but only a few percent of non-residential floor area is newly constructed or fully renovated each year. So energy saving retrofits to occupied buildings represent the greatest opportunity for near-term reductions in non-residential energy consumption.

As a result, there is a thriving market for products and services to increase the energy efficiency of occupied non-residential buildings, with domestic annual sales of about $10B. The IntelliBlinds™ Model D is targeted to one of the hottest segments of that market—energy efficient lighting retrofits for office buildings.

Office buildings enclose more floor area, and consume more energy, than any other type of non-residential building. And in office buildings, lighting consumes more energy than any other end use. Overall, 63 billion kWh are consumed each year in lighting U.S. office buildings, costing $2.75 billion in consumption and demand charges and resulting in emission of 43 million metric tons of CO2. For this reason, office buildings represent the largest fraction of the non-residential lighting retrofit market.

There are several factors that make this market segment especially attractive as a springboard for new energy saving technologies:

- Concentration of Decision-Making Authority. The authority to sign-off on energy saving retrofits is concentrated among relatively few office-building owners/operators/tenants, particularly in the major metropolitan areas that account for the bulk of the office space in the U.S. For example, in Manhattan, virtually all of the office space is controlled by just 30 entities (Energy Efficiency Trends in Residential and Commercial Buildings, page 20). This concentration facilitates marketing of energy saving technologies, and it also means that retrofitting the buildings in just a single entity's portfolio can yield substantial savings—and potentially enough revenue to recoup the costs of commercializing a new technology.

- Increasingly Stringent Standards and Codes for Energy Efficiency. As is the case with other energy consuming building technologies, lighting systems are subject to ever-increasing standards for energy efficiency. Compliance with some standards is voluntary, e.g. to gain Leadership in Energy and Environmental Design (LEED) credits to obtain a competitive advantage in the commercial real-estate market. However, many buildings are subject to mandatory compliance with state and local standards and codes.

- Increasing Availability of Capital. Energy saving retrofits yield a greater rate of return than many other types of investment. But many office building owners/operators/tenants don't have the cash to pay for retrofits, regardless of the rate of return. Traditional bank loans are one option, but the high rate of return for investments in energy efficiency—coupled with the societal benefits—is giving rise to a variety of more attractive financing options. For example, public-sector office buildings can use bonds or tax-exempt leases to finance energy saving retrofits, which are typically implemented by Energy Services Companies (ESCOs) on a turn-key basis. As another example, private-sector buildings can obtain the benefits of energy savings without any up-front capital via an Energy Services Agreement with an ESCO or project developer. Still other options exist, and more are emerging (Kim et al 2012).

- Risk Mitigation. Not only do energy saving retrofits yield a relatively high rate of return, the uncertainty in achieving the expected returns can also be lower than for most other types of investment. As a result, the companies that finance or implement energy saving retrofits often also guarantee the savings, or at least absorb some of the risk.

- Utility and Tax Incentives. Energy efficiency benefits electricity providers (because it helps reduce demand peaks) as well society as a whole (because it reduces greenhouse gas emissions and frees up capital for other investments). As a result, almost every energy efficiency project qualifies for some type of utility or government-sponsored incentive program.

For these and other reasons, the office-building retrofit market is probably the quickest and easiest avenue to achieve energy savings from new energy efficient lighting technologies.

Market is Hungry for New Products

While the above-mentioned factors create a favorable market climate, any new energy saving technology must meet four stringent requirements to achieve significant penetration in the non-residential retrofit segment:

- Rapid Payback to End-Users. Despite the increasing availability of capital and the relative lack of risk, end-users typically demand a very quick payback from energy saving retrofits. For example, the median payback period for retrofits in public-sector buildings is seven years, which represents a greater rate of return than offered by conventional investments. And the median payback in commercial office buildings—which represent the bulk of the market—is just three years.

- Rapid Payback to Developer. Even if a technology offers the potential for a rapid payback to the end-user, it won't reach the market at all unless it also offers the potential to rapidly amortize the costs of product development. This requires a high degree of production-readiness and/or proprietary or patented innovations to maximize the return on the commercialization investment. On the other hand, technologies that offer dramatic increases in energy efficiency usually require years of R&D at multiple public and private-sector entities.

- Distribution-Friendliness. A successful product must be compatible with the existing distribution network. In particular, it shouldn't require specialized installation tools or expertise, and it shouldn't compete directly with successful energy saving technologies already in the distribution pipeline. For example, market adoption of LED retrofits would probably be quicker if they didn't compete directly with high-performance T8 retrofits.

- Occupant-Friendliness. No matter how much energy it saves, any technology that might be perceived to compromise the comfort, convenience, productivity, control, or health of building occupants will have a difficult time penetrating the market. For example, early occupancy sensing lighting controls had a reputation for erratic operation, slowing market acceptance.

Few existing technologies thoroughly meet all of these requirements, limiting the total energy savings achievable in a typical retrofit project. As a result, companies that plan and implement energy saving retrofits are very hungry for appealing new technologies, so that they can more fully exploit the savings (and revenue) opportunities presented by each retrofit project in their portfolios.

When coupled with the favorable market climate, this latent demand virtually assures the success of any new energy saving technology that meets all of the market's stringent requirements.

Daylight Harvesting: An Enormous Untapped Opportunity

Much of the R&D and media interest in energy efficient lighting is currently focused on LED technology. But while LED retrofits for fluorescent luminaires are now available, the technology is still many years away from offering attractive paybacks. Until that happens, there will be only one cost-effective, occupant-friendly way to significantly reduce lighting consumption beyond the handful of technologies already used in office-building retrofits: daylight harvesting.

Daylight-harvesting lighting controls can slash lighting energy consumption by more than 50% in areas that receive plenty of daylight, paying for themselves in less than a few years. And in most office buildings, daylight levels and electrical demand peak at about the same time of day, so daylight harvesting also reduces the peak loads on the electrical grid (and the attendant kW demand charges). The occupants benefit, too, because glare-free daylight levels are positively correlated with satisfaction and productivity.

But while daylight-harvesting lighting controls have been available for decades, their market potential remains mostly untapped. For example, as of 2010, stand-alone daylight harvesting controls were controlling fewer than 1% of lamps in office buildings (2010 U.S. Lighting Market Characterization, Table 4.37).

One reason for this limited market penetration is that the bulk of the potentially daylit area in office buildings is sidelit via eye-level view windows. View windows that receive enough daylight to make daylight harvesting worthwhile must also be shaded to control occasional glare. And with manually adjustable shades, the windows remain over-shaded most of the time, reducing the achievable savings and lengthening the payback period.

What's Been Missing: Cost-Effective Dynamic Daylight Control (DDC)

The key to effective daylight harvesting in sidelit areas was demonstrated decades ago via government sponsored research: Dynamic Daylight Control (DDC) via automated shading. DDC ensures enough daylight to make harvesting worthwhile, typically doubling the savings.

Unfortunately, conventional DDC technology is so expensive that, despite substantially increasing the savings, it also substantially increases the payback period for daylight harvesting. The estimated median payback in typical retrofit applications is about 10 years, far too long to be considered cost-effective for mainstream use in the U.S. And the technology is also complex and difficult to distribute. As a result, while the effectiveness of the technology was conclusively demonstrated in the mid-1990's, its market penetration remains negligible—only a few tenths of a percent, according to our own research.

So, while the necessary lighting controls are inexpensive and robust, the lack of a market-friendly DDC technology has hindered exploitation of daylight harvesting's enormous potential. The IntelliBlinds™ Model D miniblind actuator was developed specifically to fill that void.

Unlocking Daylight Harvesting's Full Potential

Thanks to multiple innovations, the IntelliBlinds™ Model D miniblind actuator is the first and only DDC technology that meets all of the market's stringent requirements:

- Cost-Effectiveness. Like conventional DDC technology, IntelliBlinds™ more than doubles the energy savings achievable through daylight harvesting—but at 70% lower cost. More importantly, IntelliBlinds™ costs less than all be the least-expensive daylight harvesting lighting controls, so it significantly shortens the payback period for daylight harvesting. Depending on the type of lighting control it's used with, IntelliBlinds™ can shorten the daylight harvesting payback period by a factor of two or more, yielding a commercially attractive payback of 2–4 years in typical installations.

- Ease of Commercialization. IntelliBlinds™ has a simple, mature design that requires only off-the-shelf components and inexpensive tooling, and is well-suited to existing distribution channels.

- Complementary Relationship to Established Technologies. Thanks to its patented innovations, IntelliBlinds™ faces no direct competition: no other DDC technology is remotely cost-effective in retrofit applications. So the energy saved by IntelliBlinds™ can't be saved by any other means—it's additive with the savings provided by other successful technologies on the market, providing an important new source of savings (and revenues) in retrofit projects.

- Occupant-Friendliness. IntelliBlinds™ operates unobtrusively, enhances the subjective quality of the visual environment, and is controlled directly by the building occupants (rather than a computer or the building's engineering staff).

These attributes make the IntelliBlinds™ Model D uniquely capable of unlocking daylight harvesting's enormous untapped market potential.

Benchmark Daylight-Harvesting Configurations

The IntelliBlinds™ Model D works synergistically with daylight-harveseting lighting controls, so its market potential depends partly on their cost-effectiveness. But today's daylight-harvesting lighting systems span an enormous range of cost and capability. So, to facilitate projection and presentation of IntelliBlinds™ market impacts, this analysis addresses only a subset of possible configurations.

The daylight-harvesting configurations selected for analysis are those we consider to be the most cost-effective* for retrofit applications. These six configurations—all of which use stand-alone, fixture-integrated lighting controls—are as follows:

- Three types of lighting control: Switching-Only (SO), Dimming-Only (DO), and Dimming-and-Switching (D&S)

- Two variations in number of controlled luminaires/zones:

- Single zone: a single controlled luminaire in the near zone (i.e. within 1.0 window-head-heights from the window); closed-loop control with fixture-integrated photosensor.

- Dual zone: two controlled luminaires; one in the near zone and one in the far zone (between 1.0 and 2.0 window-head-heights from the window); near-zone luminaire using closed-loop control using fixture-integrated sensor; far-zone luminaire using open-loop control based on near-zone photosensor.

If IntelliBlinds™ is used with a daylight-harvesting configuration other than these maximally cost-effective* configurations, projected market penetration will be lower, but the impact of IntelliBlinds™ on market penetration will be greater. So limiting the analysis to these configurations is conservative from the standpoint of quantifying the market value of the IntelliBlinds™ Model D.

Applicable Floor Area

There are 15 billion square feet of floor area in U.S. office buildings. Published estimates of the percentage of this floor area that can be daylit range from 30% to 50%; our own analysis indicates that 29% of the floor area in U.S. office buildings is close enough to a window to benefit from daylight harvesting. All of this 29%—or 4.4 billion square feet—could potentially benefit from daylight harvesting lighting controls.

Of this fraction, about 25% is sidelit via windows that require no shading (e.g. north-facing windows). These windows receive relatively little daylight, so the savings from daylight harvesting are relatively low. However, because these windows aren't shaded, they actually admit more daylight than the typically over-shaded windows with sunnier exposures, so the actual savings are greater, and there is little need for DDC.

The other 75%—or 3.3 billion square feet—receives enough daylight to require window shading. This is the area where daylight harvesting could potentially achieve the greatest savings, but where chronic over-shading actually results in the least savings.

Of this 3.3 billion square feet, 75%—or 2.5 billion square feet—has windows equipped with $2 billion worth of horizontal miniblinds. IntelliBlinds™ can be quickly retrofitted to all of these miniblinds, fully leveraging this $2 billion investment to slash the cost of DDC. This 2.5 billion square feet is the highest-payoff floor area for daylight-harvesting retrofits incorporationg IntelliBlinds™, so that figure corresponds to 100% market penetration in the projections given below.

Projected Market Penetration

The percentage of the applicable floor area discussed above that is ultimately equipped with IntelliBlinds™ will depend on how potential buyers respond to its value proposition. That, in turn, can be quantified via a market penetration model.

Penetration Model

Market penetration models for non-residential energy saving technologies typically estimate penetration as a function of the simple payback period: for paybacks longer a certain threshold, penetration is virtually zero; for paybacks shorter than this threshold, penetration varies inversely with the payback period.

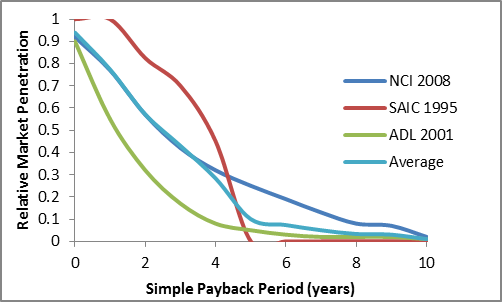

The following chart shows the projected market penetration versus payback for the three models most frequently cited in published studies on energy saving retrofits, along with an "average model" curve representing the average of the three model penetrations versus payback:

The "average model" curve is nearly linear for paybacks between 0 and 5 years, with penetrations of 94% at 0 years and 10% at 5 years. This is very similar to (but slightly more conservative than) our own independent model*, so we chose to use it as the basis for the market projections below.

Conservatism in Projection of IntelliBlinds™ Impact

Penetration models like those of Chart 1 are usually calibrated with the actual market performance of technologies whose payback periods can be reliably predicted in any given installation. That's the case for daylight harvesting with IntelliBlinds™. For daylight harvesting without some form of DDC, however, the paybacks can't be reliably predicted in sidelit areas with manually operated shades.

The unpredictability of real-world sidelighting paybacks is well-known among both daylighting professionals and investors in non-residential energy efficiency. For example, at least one widely-cited study shows that daylight harvesting controls typically don't provide the expected savings in sidelit areas ("Sidelighting Photocontrols Field Study" 2005, page 8). As another example, a 2003 industry survey found that daylighting controls are significantly less likely than other types of lighting control to meet buyers' energy savings expectations (DiLouie 2003).

It's reasonable to assume that this general awareness of payback unpredictability is hindering adoption of daylight harvesting. Therefore, a payback-only model like those of Chart 1 will over-predict the ultimate market penetration of daylight harvesting without DDC. This doesn't affect the projections of the absolute market penetration of IntelliBlinds™, but it does add a measure of conservatism to the following projections of the increase in daylight harvesting usage due to IntelliBlinds™.

Payback Distribution

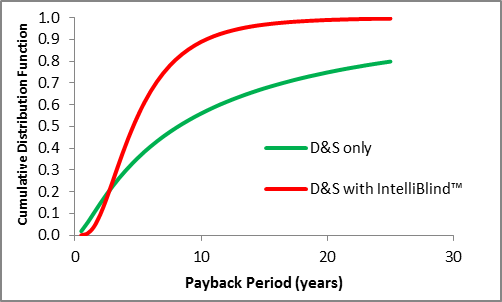

Obviously, the payback period for any energy saving technology will vary across the market. For example, the following chart shows the cumulative distribution functions of the paybacks across U.S. office buildings, with and without IntelliBlinds™, for a dual-zone Dimming-and-Switching (D&S) daylight-harvesting lighting control:

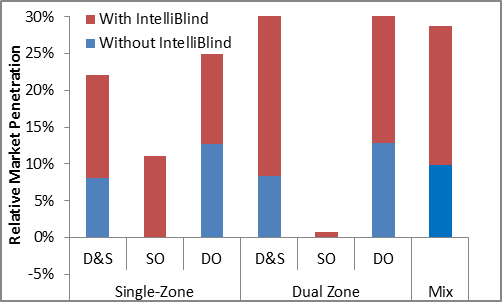

Projected Penetration by Daylight-Harvesting Configuration

The penetration model of Chart 1 can be used to convert a payback distribution such as that of Chart 2 into a penetration distribution, which can then be integrated to yield the projected relative market penetration. The following chart shows the relative penetrations obtained in this manner, with and without IntelliBlinds™, for various daylight-harvesting configurations:

Aggregate Penetration

The penetration projected by models such as those shown in Chart 1 are for the entire class of all products that provide the same benefit in the same way. Per that definition, all six daylight-harvesting lighting configurations of Chart 3 could be considered to belong to the same class, i.e. they could be considered to compete for a share of the same market*. So the aggregate penetration of all six configurations of Chart 3 cannot exceed the penetration of the tallest column, and will depend on the relative proportion of each configuration in the installed base.

On the other hand, the aggregate penetration will almost certainly be greater than the average across all six configurations of Chart 3, because buyers will almost certainly choose configurations with taller columns more often than those with shorter columns.

Therefore, the aggregate penetration will be somewhere between the maximum and average penetrations across the six configurations. A reasonable estimate for the aggregate penetration is the average of the maximum and average penetrations. This value appears as the "Mix" (rightmost) column on Chart 3.

Significance of Projected Penetration

Each column of Chart 3 represents the ultimate, demand-limited penetration of daylight-harvesting retrofits to non-residential buildings:

- Ultimate refers to the penetration at market saturation. Time to reach saturation in the non-residential energy savings market is typically estimated at 15–30 years.

- Demand-limited means that the projections assume that penetration is limited only by buyer demand, and not by commercialization or marketing resources.

- Retrofits means that only retrofit installations are included in the numerator of the penetration ratio; installations due to new construction, major renovations, or replacements of worn-out equipment are excluded.

IntelliBlinds™ Impact

Per Chart 3, the IntelliBlinds™ Model D will increase the aggregate relative market penetration of daylight harvesting in IntelliBlinds™-applicable floor areas by about 70%. The maximum and minimum impacts are for Switching-Only (SO) and Dimming-Only (DO) controls, respectively:

- IntelliBlinds™ has an enormous impact on the Switching-Only (SO) control because, without it, there is rarely enough daylight for the lights to switch off, so the savings are negligible. IntelliBlinds™ increases the daylight level enough to keep the lights off for a significant fraction of the lighting hours, dramatically reducing the payback period and increasing the penetration.

- On the other hand, IntelliBlinds™ actually slightly reduces the penetration of the single-zone Dimming Only (DO) control. That's because a single-zone configuration doesn't exploit all of the added daylight provided by IntelliBlinds™, and because the benefits from current utility rebate programs are far greater for DO controls than for DDC systems like IntelliBlinds™. If DDC systems received the same rebate (on a per kWh-saved basis) as DO lighting controls, then the projected penetration would be significantly greater with than without IntelliBlinds™.

Projected Aggregate Floor Area Equipped with IntelliBlinds™

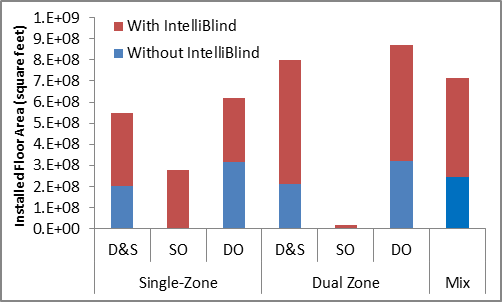

The projected aggregate floor area equipped with an energy saving technology is the product of its applicable floor area and its projected market penetration. Using the floor area applicable* to IntelliBlinds™ as the basis, the following chart shows the projected aggregate floor area equipped with daylight-harvesting lighting controls, with and without IntelliBlinds™, for the six configurations previously shown in Chart 3:

With the exception of the single-zone DO and dual-zone SO controls, IntelliBlinds™ dramatically boosts the projected floor area equipped with daylight-harvesting lighting controls: the increase ranges from 150 to 380 million square feet (depending on the mix of lighting control configurations), to an aggregate IntelliBlinds™ installed base of 250 to 500 million square feet. The most likely outcome, shown in the "Mix" column, will be an increase in the daylight-harvesting installed base of 220 million square feet, with a total IntelliBlinds™ installed base of 590 million square feet.

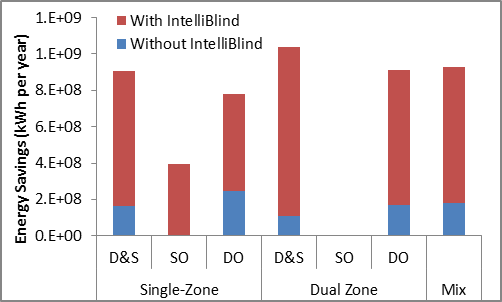

Projected Aggregate Annual Energy Savings

The IntelliBlinds™ Model D boosts the aggregate energy savings in two ways:

- As shown above, it increases the floor area equipped with daylight-harvesting lighting controls.

- By eliminating the over-shading loss, it more than doubles the median energy savings across that floor area.

Obviously, the reduction in Energy Use Intensity (EUI) due to any energy saving technology will vary across the market. The aggregate annual kWh savings can be estimated by multiplying the median* EUI savings by the installed floor areas discussed above. Using the floor area applicable to IntelliBlinds™ as the basis, the following chart shows the projected aggregate energy savings from daylight harvesting over IntelliBlinds™-applicable floor areas, with and without IntelliBlinds™, for the six configurations previously shown in Chart 4:

Per the "Mix" column, IntelliBlinds™ will increase the projected aggregate energy savings from daylight harvesting by 560 million kWh per year.

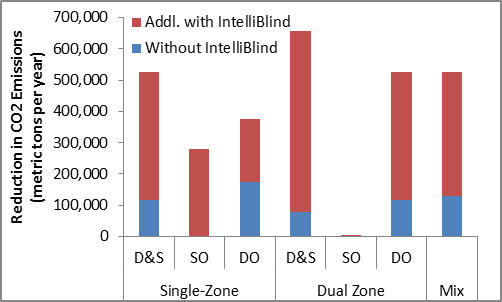

Projected Aggregate Annual Reduction in CO2 Emissions

According to the EPA, 7.06x10-4 metric tons of CO2 are released into the atmosphere for each kWh of electricity consumed in the U.S. Multiplying the aggregate energy savings of Chart 5 by this quantity yields the aggregate reduction in CO2 emissions over the floor area applicable to IntelliBlinds™:

Per the "Mix" column, IntelliBlinds™ will reduce CO2 emissions by an additional 400 million metric tons per year.

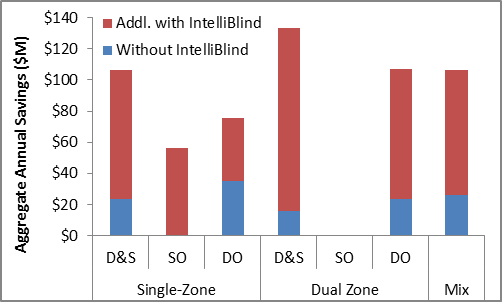

Projected Aggregate Annual Dollar Savings

Daylight harvesting saves dollars in two ways: by reducing energy consumption (per kWh) charges, and by reducing peak demand (per kW) charges. Because the energy savings from daylight harvesting are due to lighting power reductions that occur when electrical demand is near its daily peak, the savings in demand charges are roughly proportional to the savings in consumption charges.

Consumption and demand charges vary by utility, with a median non-residential consumption charge of $0.10 per kWh and a median ratio of total utility charges to consumption charges of 1.4. In other words, the median total dollar savings from daylight harvesting are $0.14 per kWh saved. Multiplying this figure by the aggregate energy savings discussed above yields the following aggregate dollar savings over the floor area applicable* to IntelliBlinds™:

Per the "Mix" column, IntelliBlinds™ will boost the aggregate annual dollar savings from daylight harvesting by $80 million per year.

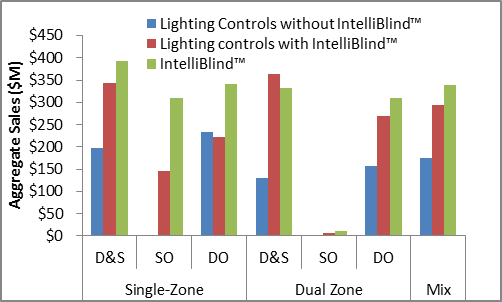

Projected Cumulative Sales

Multiplying the projected installed floor areas (per Chart 4) by the median installed costs per square foot yields the projected cumulative sales of daylight-harvesting equipment:

Per the "Mix" columns, IntelliBlinds™ will boost the cumulative sales of daylight-harvesting lighting controls by $120 million, with IntelliBlinds™ itself generating $340 million of cumulative sales at ultimate market penetration.

Confidence Level

As with any market projection, the numbers presented here have substantial uncertainty. However, for products whose primary benefit is economic (as is the case with energy saving retrofits), rather than subjective (as is the case with many consumer devices), market projections can be fairly accurate.

Further, these projections of the absolute market performance of the IntelliBlinds™ Model D are conservative in at least four respects:

- The projections exclude installations due to new construction, major renovations, or replacement of worn-out lighting systems. Only a few percent of non-residential floor area is newly constructed or renovated each year, but over the entire market lifecycle of an energy saving technology—which can span decades—new construction alone can account for far more sales than retrofits.

- The projections assume no increase in total non-residential floor area, whereas the U.S. EIA has projected that total non-residential floor area will rise to over 100 billion square feet by 2030—an increase of over 40% relative to the assumptions underlying the projections (EIA Annual Energy Outlook 2010).

- The projections are limited to office buildings, but there is substantial floor area in other building types that would benefit equally from daylight harvesting with IntelliBlinds™.

- The projections are based solely on the reduction in the median daylight-harvesting payback period due to use of IntelliBlinds™. However, IntelliBlinds™ also reduces the uncertainty in the payback period, which is arguably just as important in influencing purchasing decisions. IntelliBlinds™ also improves the building occupants' visual environment (likely enhancing morale and productivity), which will likely also positively influence market penetration.

On the other hand, there are two areas in which the projections are arguably optimistic:

- The projections assume flat electricity prices. Obviously, any decrease or increase in electricity prices would tend to decrease or increase, respectively, the market appeal of energy saving technologies. As of early 2012, the prevailing wisdom was that rising domestic production of natural gas—coupled with continued sluggishness of the global economy and gradual increase in energy efficiency—will drive retail electricity prices downward over the next decades. Therefore, it could be argued that the assumption of flat prices is optimistic in the context of these projections. However, a spike in the cost of natural gas in the summer of 2013 caused an increase in electricity prices. And rising use of plug-in hybrids could increase overall electricity consumption, putting upward pressure on prices. And, of course, small increases in GDP growth relative to the assumptions of 2012 could push electricity prices higher. Overall, therefore, the assumption of flat prices seems reasonable.

- The projections assume that the median Lighting Power Density (LPD) in office buildings remains at 1.46 Watts per square foot. The LPD has decreased over the last several decades as lighting systems have grown more efficient, and this trend will certainly continue. For example, LPD standards for new construction specify a maximum LPD of 0.9 Watts, and LED technology—when it becomes cost-effective for mainstream area-lighting use—will likely push the LPD even lower. However, a gradual increase in efficiency is characteristic of all building systems, and is therefore implicitly factored into penetration models such as those shown in Chart 1.

Overall, therefore, the projections presented herein are believed to represent an objective and reasonably accurate picture of the market potential of the IntelliBlinds™ Model D.

Summary of Key Points

- The IntelliBlinds™ Model D was developed to fill a long-standing void: the absence of a market-friendly technology for Dynamic Daylight Control (DDC) in retrofit daylighting applications

- While conventional DDC technology more than doubles the savings in lighting energy from daylight harvesting, it's so expensive that it actually lengthens the payback period. IntelliBlinds™ saves even more lighting energy, yet it costs only one-third as much, so it substantially shortens the median payback period—to just 2–4 years in typical retrofits

- Like conventional DDC technology, IntelliBlinds™ also provides other benefits: it reduces payback uncertainties due manual shading adjustments, reduces the energy consumed by the host building's HVAC system, and enhances occupants' comfort and productivity

- Using published single-parameter market penetration models based solely on payback period—and neglecting the other benefits—the IntelliBlinds™ Model D is projected to:

- Increase the installed base of daylight-harvesting lighting controls by 220 million square feet, with IntelliBlinds™ itself achieving an installed base of 590 million square feet

- Increase aggregate energy savings from daylight harvesting by 560 million kWh per year

- Reduce CO2 emissions by another 400 thousand metric tons per year

- Boost aggregate dollar savings from daylight harvesting by $80 million per year

- Boost the cumulative sales of daylight-harvesting lighting controls by $120 million, with IntelliBlinds™ itself generating $340 million of cumulative sales at ultimate market penetration

- These projections are conservative in that they don't consider likely growth in non-residential floor area, use of IntelliBlinds™ beyond office buildings, or sales due to new construction, major renovations, or replacement of worn-out systems